Employer Obligations: Are Pay Stubs a Must?

Published:• 0 min read

Introduction

As an employee, it is important to understand your rights and what you are entitled to regarding your pay. One of the most common questions that employees have is whether their employer must give them a pay stub. In this guide, we will provide you with a comprehensive answer to this question and other related information you should know as an employee.

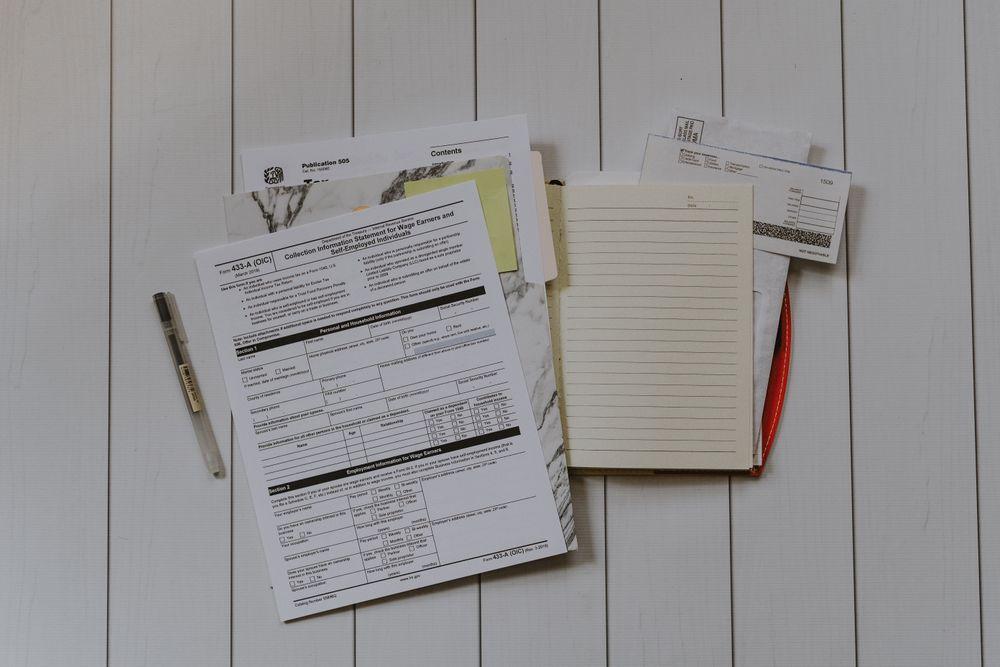

What is a Pay Stub?

A pay stub is a document that outlines the details of your paycheck, including your earnings, deductions, and other important information. It records your pay and allows you to track how much you earn and how much is being deducted from your paycheck for taxes, insurance, and other expenses.

Is My Employer Required to Give Me a Pay Stub?

The answer to this question depends on the state where you work. Some states, such as California and New York, require employers to provide employees with a pay stub each time they are paid. Other states, such as Alabama and Florida, do not have any specific laws requiring employers to provide pay stubs.

However, even in states where pay stubs are not legally required, most employers still provide them to their employees as a matter of practice. This is because pay stubs are an important record of an employee's pay and are often necessary for tax and other financial purposes.

What Information Should be Included on a Pay Stub?

If your employer provides you with a pay stub, certain pieces of information should be included. These include:

- Your name and the name of your employer

- The pay period for which you are being paid

- Your gross pay (the total amount you earned before any deductions)

- Your net pay (the amount you actually receive after deductions)

- The date of the paycheck

- The amount of federal, state, and local taxes withheld

- The amount of Social Security and Medicare taxes withheld

- Any other deductions, such as for health insurance or retirement contributions

- Your year-to-date earnings and deductions

Can I Request a Pay Stub from My Employer?

You can request one if your employer does not provide a pay stub. Most employers are willing to provide pay stubs upon request, and some may even have a policy in place for employees to access their pay stubs online.

It is important to remember that your employer may have a limited amount of time to provide you with a pay stub after your request. Some states have laws requiring employers to provide pay stubs within certain days after a request is made.

What Should I Do if I Believe My Employer is Withholding Pay?

If you believe that your employer is withholding pay or not providing you with accurate pay stubs, you can take steps to address the situation. The first step is to speak with your employer or human resources representative to try to resolve the issue. If this does not work, you may need to file a complaint with the appropriate government agency, such as the Department of Labor.

Conclusion

In summary, while the answer to whether your employer is required to give you a pay stub depends on the state you work in, it is generally a good practice for employers to provide them. Pay stubs are an important pay record and are often necessary for tax and other financial purposes. If your employer does not provide pay stubs, you can request one. And if you believe your employer is withholding pay or providing inaccurate pay stubs, there are steps you can take to address the situation.